Certainly! Here is a comprehensive report on Prime Minister Shehbaz Sharif’s directives to the FBR regarding tax evasion crackdown and taxpayer facilitation, based on the latest available information.

💰 PM Shehbaz Orders FBR to Target Tax Evaders and Facilitate Taxpayers: Comprehensive Reform Initiative

🔍 1. Overview of the Directive

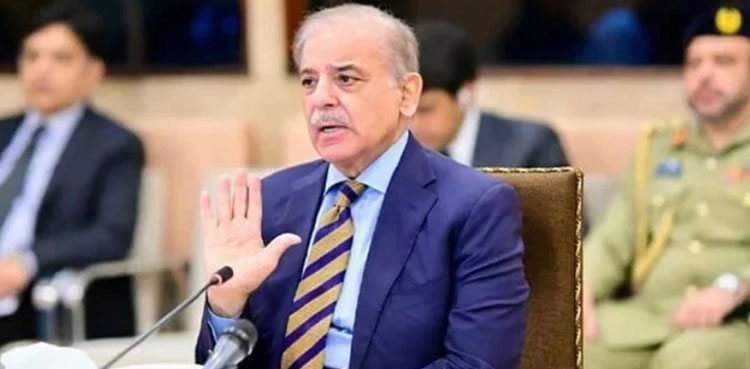

Prime Minister Shehbaz Sharif has issued comprehensive directives to the Federal Board of Revenue (FBR) to intensify efforts against tax evasion while simultaneously improving facilities for compliant taxpayers. These instructions were delivered during a high-level meeting on FBR reforms held on Tuesday, September 9, 2025, attended by key federal ministers and senior officials . The Prime Minister emphasized that this dual approach is essential for broadening Pakistan’s tax base and achieving the country’s ambitious revenue collection targets.

📜 2. Key Directives from the Prime Minister

⚖️ 2.1 Crackdown on Tax Evasion

PM Shehbaz ordered a comprehensive crackdown on tax evasion, emphasizing the need to:

Identify and pursue tax-evading individuals and companies through both FBR’s internal resources and private sector expertise

Hire professional services specifically for tracing tax evaders and recovering outstanding dues

Engage top international audit firms for third-party reviews of misdeclaration and under-invoicing in customs clearance

Launch a public awareness campaign regarding government measures against tax evasion

🤝 2.2 Taxpayer Facilitation and Recognition

The Prime Minister equally emphasized facilitative measures:

Foster a business-friendly environment and ensure provision of all possible facilities to taxpayers

Expedite completion of the Income and Sales Taxpayers’ Directory to recognize and honor compliant taxpayers

Implement a scientific auditing system for transparent evaluation processes

📊 3. Statistical Context of Tax Evasion in Pakistan

The urgency of these measures is underscored by Pakistan’s significant tax evasion problem:

| Aspect | Figure | Source |

|---|---|---|

| Estimated tax evasion by high-income individuals | Rs. 1.2 trillion annually | |

| Number of high-income individuals underpaying taxes | Approximately 670,000 | |

| Total income tax liability of high-earners | Rs. 1.7 trillion | |

| Actual contribution from high-earners | Rs. 500 billion | |

| Tax collection target for 2025-26 | Rs. 14.13 trillion ($47.4 billion) |

FBR Chairman Rashid Mahmood Langrial had previously revealed that the top 1% of high-income individuals (approximately 670,000 people) have an estimated income tax liability of Rs. 1.7 trillion but contribute only Rs. 500 billion, evading approximately Rs. 1.2 trillion through underreporting incomes .

🏛️ 4. Institutional Reforms and Administrative Measures

🔄 4.1 Organizational Restructuring

The FBR has undertaken significant administrative reforms:

Transfer and posting of officers in BS-17, BS-18, and BS-21 grades to optimize resource allocation

Rotation of officers through different geographical regions and functional areas (audit, enforcement, taxpayer facilitation) to build versatile expertise

Merit-based postings to foster accountability and ensure high-performing officers are placed where they can have greatest impact

📞 4.2 Taxpayer Support Systems

The FBR has enhanced its taxpayer support mechanisms:

Helpline services (051-111-772-772) providing free, fast, and reliable assistance

International standard CRM system ensuring three-tier support with 24-hour resolution for most complaints

Extended tax return deadlines when necessary, such as the recent extension to August 4, 2025, for compliant taxpayers

🌍 5. Broader Economic Context and Challenges

Pakistan faces significant structural challenges in tax administration:

Low tax-to-GDP ratio despite a population of over 240 million

Only 2.6 million tax return filers (increased from 1.9 million in one year), with a target of 5 million in two years

Large informal economy complicating sales tax collection

67 million workforce participants, with over 60% below the taxation threshold of Rs. 50,000 per month

The government has set a record-high tax collection target of Rs. 14.13 trillion ($47.4 billion) for fiscal year 2025-26, representing a 9% increase from the previous year . Meeting this target is considered essential for reducing reliance on external debt and ensuring long-term fiscal sustainability.

💡 6. Innovative Approaches and Technological Integration

The reform initiative incorporates several innovative elements:

Digital ecosystem modernization for FBR to increase collection efficiency

Simplified digital tax returns to increase compliance and widen the tax base

Scientific auditing framework for third-party evaluations of customs misdeclaration and under-invoicing

Super auditors appointed to comprehensively review customs clearance and the risk management system

📈 7. Expected Outcomes and Impact

The Prime Minister’s directives are expected to yield multiple benefits:

Broadened tax base through improved compliance and reduced evasion

Enhanced revenue collection through improved enforcement mechanisms

Improved taxpayer morale through recognition and facilitation measures

Systemic improvements in customs procedures and risk management

Increased public awareness of tax obligations and government enforcement efforts

🏁 8. Implementation Challenges and Considerations

While the directives are comprehensive, several implementation challenges remain:

Resistance from entrenched interests benefiting from current evasion opportunities

Capacity constraints within FBR requiring private sector supplementation

Need for continuous international auditing to maintain system integrity

Balancing enforcement with facilitation to avoid discouraging compliant taxpayers

💎 9. Conclusion

Prime Minister Shehbaz Sharif’s directives to the FBR represent a comprehensive approach to tackling Pakistan’s chronic revenue challenges. By simultaneously targeting tax evaders through enhanced enforcement mechanisms and facilitating compliant taxpayers through improved services and recognition, the government aims to create a more equitable and efficient tax system. The success of these measures will be crucial for achieving Pakistan’s ambitious revenue targets, reducing dependence on external debt, and ensuring long-term fiscal sustainability. The involvement of international auditors, private sector expertise, and the implementation of technological solutions demonstrate the government’s commitment to structural reforms in tax administration. However, effective implementation will require sustained political commitment and institutional capacity building within the FBR